- Get link

- Other Apps

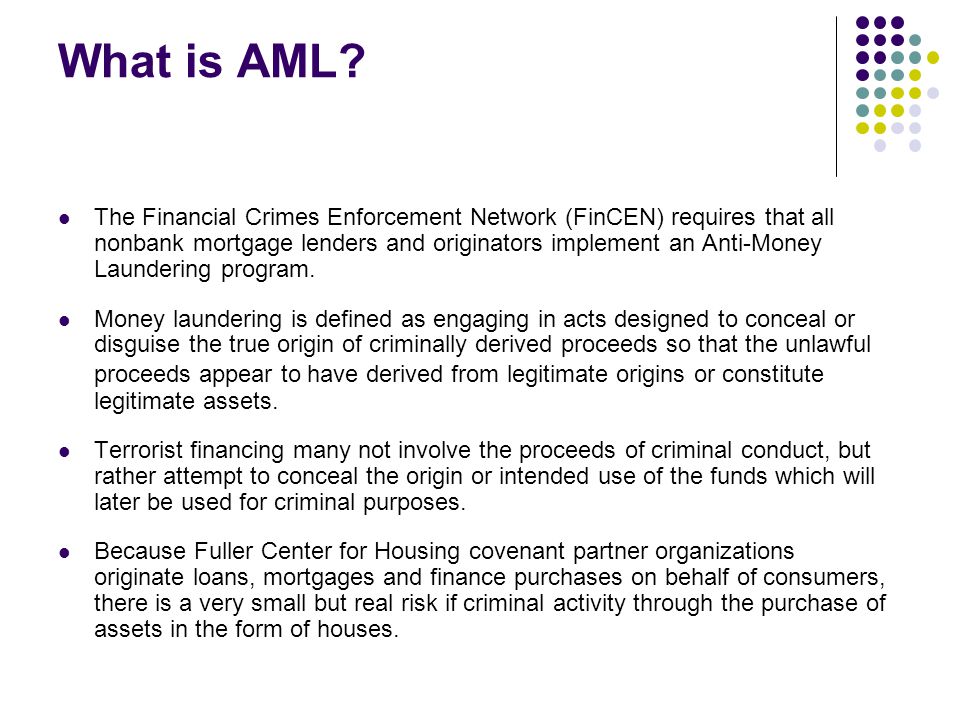

The concept of cash laundering is very important to be understood for these working within the financial sector. It is a process by which soiled money is converted into clean cash. The sources of the cash in actual are legal and the money is invested in a method that makes it look like clean cash and conceal the id of the felony a part of the cash earned.

While executing the financial transactions and establishing relationship with the brand new clients or maintaining present customers the responsibility of adopting adequate measures lie on each one who is part of the group. The identification of such component in the beginning is easy to take care of as a substitute realizing and encountering such conditions in a while within the transaction stage. The central financial institution in any country gives complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such conditions.

If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Money laundering requires an underlying primary profit-making crime such as corruption drug trafficking market manipulation fraud tax evasion along with the intent to conceal the proceeds of the crime or to further the criminal enterprise.

What Is Anti Money Laundering Quora

Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme.

Definition of anti money laundering. Directly or indirectly attempted to indulge or knowingly assisted or knowingly is a party or. Anti-Money Laundering Law means applicable laws or regulations in any jurisdiction in which any Loan Party or any Subsidiary is located or doing business that relates to money laundering any predicate crime to money laundering or any financial record. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money.

Sound management of risks related to money laundering and financing of terrorism. Again a national system must be flexible enough to be able to extend countermeasures to new areas of its own economy. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme.

Money laundering has been defined in the Prevention of Money Laundering Act of 2002 PMLA under section 3 where a person shall be guilty of the offence if such person is found to have. Money laundering and the financing of terrorism are financial crimes with economic effects. AML legislation is becoming increasingly strict for financial service providers.

Anti-money laundering definition of Anti-money laundering by Medical dictionary. Anti-money laundering measures often force launderers to move to parts of the economy with weak or ineffective measures to deal with the problem. The FATF was responsible for the creation of most anti-money laundering standards and it made a framework for countries to follow.

It likewise refers to a single series or combination or pattern of unusually large and complex transactions in excess of Four million Philippine pesos Php400000000 especially cash deposits and investments having no credible purpose or origin underlying trade obligation or contract. Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation.

Anti-money laundering laws entered the global arena soon after the Financial Action Task Force was created. They must be prevented from financing money laundering and or terrorism. After putting this framework into effect the FATF then began to systematically identify countries that.

If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities.

Anti Money Laundering Aml Ppt Video Online Download

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

Get Our Image Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies

Anti Money Laundering And Counter Terrorism Financing

Explore Our Sample Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Anti Money Laundering Overview Process And History

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Money Laundering Evaluation Employee Employee Evaluation Form

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

How To Prevent Illegal Money Laundering Activities In Bitcoin Exchange Business Money Laundering Anti Money Laundering Law Bitcoin

Guide To Money Laundering In The Year 2020 Money Laundering Financial Institutions The Year 2020

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

The world of laws can appear to be a bowl of alphabet soup at times. US cash laundering laws are not any exception. We've compiled a list of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending monetary companies by decreasing danger, fraud and losses. We have massive bank experience in operational and regulatory risk. We have now a powerful background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many adverse penalties to the organization due to the risks it presents. It increases the chance of main dangers and the opportunity price of the bank and in the end causes the financial institution to face losses.

Comments

Post a Comment