- Get link

- Other Apps

The concept of cash laundering is very important to be understood for these working within the monetary sector. It is a process by which soiled money is transformed into clean money. The sources of the cash in actual are criminal and the cash is invested in a means that makes it appear like clear cash and conceal the identity of the felony part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the brand new prospects or sustaining current prospects the duty of adopting sufficient measures lie on each one who is a part of the organization. The identification of such component to start with is simple to take care of as a substitute realizing and encountering such situations later on within the transaction stage. The central financial institution in any nation supplies full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such conditions.

For example an individual who commits money laundering is now liable on summary conviction to a fine not less than 100 and not more than 500 of the proceeds of the crime and in the case of a corporate entity a fine of not less than 300. A further amendment to Section 43 of the FSA.

Anti Money Laundering And Counter Terrorism Financing Law And Policy Showcasing Australia Brill

Upon its introduction it was intended that the AMLCTF Act would be further amended by a second tranche of reforms extending to designated non-financial businesses.

Features of anti money laundering act. Imposes requirements on customer identification record-keeping and reporting of covered and suspicious transactions. Relaxes strict bank deposit secrecy laws. These recommendations were issued in 1990 and have been amended several times.

On January 1 2021 the Anti-Money Laundering Act of 2020 AMLA contained in the William M. Frequency of On-site inspections. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules.

Thornberry National Defense Authorization Act of 2020 became lawThe AMLA expands existing anti-money laundering AML related requirements in various ways some of which are covered in prior alerts referenced hereinHere we discuss two more significant features of the AMLA. Ad Vast Experience in rAbs RD. Ad Vast Experience in rAbs RD.

The AMLO was reframed via the Anti-Money Laundering Act 2010 AMLA and various changes were incorporated in it including a well-built preamble and a thorough definition of money laundering21 The feature of combating terrorist financing is also included in the preamble. State of mind of a person includes. Last February 15 2013.

To ensure compliance with its law the Act imposes stringent sanctions for various money laundering infractions in the form of fines and imprisonment. The Money Laundering Control Act Of 1986 The Money Laundering Control Act of 1986 was written to make money laundering a federal crime. Partners Stephanie Brooker and M.

This revision of the Anti-Money Laundering Act or AMLA aims to strengthen it further and help prevent the Philippines from being blacklisted by the Financial Action Task Force FATF. Criminalization of offence s of money laundering and the financing of terrorism. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others.

Introduction of Advisors as a new category of persons subject to AMLA. Standard antimoney laundering and counterterrorism financing program has the meaning given by subsection 84 1. The applicable laws have also been specified as including the Financial Intelligence and Anti- Money Laundering Act the Prevention of Terrorism Act alongside any applicable enactment or guidelines or the conditions of its license authorization or registration.

To impose certain duties on institutions and other persons businesses and professions who might be used for money laundering purposes. Provides for freezingseizureforfeiture recovery of dirty moneyproperty. A the knowledge intention opinion suspicion belief or purpose of the person.

The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic. 1 its focus on. The following is a summary of the most significant changes to the AML legal landscape including.

Creates a Financial Intelligence Unit FIU. AMLA applies if a person or entity is entitled to dispose of funds or other assets and thus acts as a so-called financial intermediary. Furthermore the Anti-Money Laundering Council AMLC now has an added function to require the Land Registration Authority LRA and all its Registries of Deeds to submit to the AMLC reports on all real estate transactions involving an amount in excess of Five hundred thousand pesos P50000000 within fifteen 15 days from the date of registration of the transaction in a form to be.

Kendall Day are the authors of The Anti-Money Laundering Act of 2020s Corporate Transparency Act which is Chapter 1 of Anti-Money Laundering 2021 published by International Comparative Legal Guides on May 25 2021. The most important features of these recommendations are generally as follows. Currently the provision of pure advisory services is not subject to the Anti-Money Laundering Act.

The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 Cth AMLCTF Act is the principal legislative instrument although there are also offence provisions contained in Division 400 of the Criminal Code Act 1995 Cth. Salient features Provision of Punishment for money-laundering. Salient Features of RA.

To make orders in relation to. 9160 The Anti-Money Laundering Act AMLA of 2001 a. An Act to provide for the prohibition and prevention of money laundering the establishment of a Financial Intelligence Authority and a Financial Intelligence Authority Board in order to combat money laundering activities.

In the following the main features of the draft law will be summarized and explained. RA 10365 was signed into law by President Benigno Aquino Jr. Forty Recommendations for Anti-Money Laundering.

Dutch Authorities Set To Draft Stricter Anti Money Laundering Laws Btcmanager Anti Money Laundering Law Money Laundering Anti

Arab Republic Of Egypt Detailed Assessment Report On Anti Money Laundering And Combatting The Financing Of Terrorism

Anti Money Laundering Act Philippines

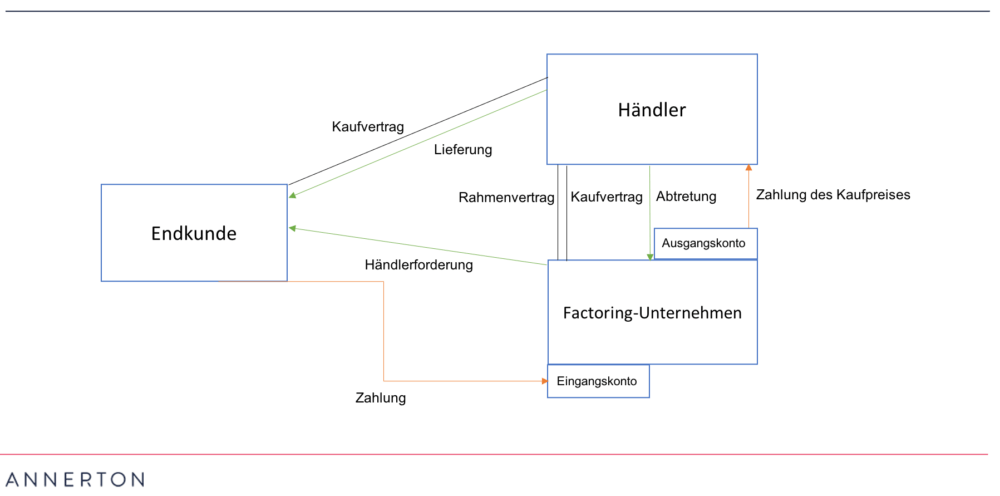

Factoring And Anti Money Laundering Law

Stricter Anti Money Laundering Regulations For Financial Institutions With Non Eu Subsidiaries

Pdf Anti Money Laundering Regulations And Its Effectiveness

Amazon Com Anti Money Laundering Awareness And Compliance Ebook Kevin Sullivan Kindle Store Money Laundering Anti Money Laundering Law Kevin Sullivan

Anti Money Laundering Act Philippines

How To Prevent Illegal Money Laundering Activities In Bitcoin Exchange Business Money Laundering Anti Money Laundering Law Bitcoin

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering

What Is Anti Money Laundering Aml Money Laundering Financial Literacy Money

Papua New Guinea Anti Money Laundering And Combating The Financing Of Terrorism Mutual Evaluation Report

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Anti Money Laundering Overview Process And History

The world of laws can look like a bowl of alphabet soup at instances. US money laundering rules are not any exception. We now have compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Danger is consulting agency focused on defending financial companies by reducing risk, fraud and losses. We've huge bank experience in operational and regulatory danger. We've got a powerful background in program management, regulatory and operational risk as well as Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many antagonistic consequences to the group as a result of dangers it presents. It will increase the chance of main dangers and the chance value of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment