- Get link

- Other Apps

The idea of cash laundering is very important to be understood for these working within the monetary sector. It's a course of by which dirty money is transformed into clear cash. The sources of the money in actual are legal and the cash is invested in a method that makes it appear to be clean cash and hide the identification of the legal a part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new customers or sustaining existing clients the responsibility of adopting enough measures lie on each one who is part of the group. The identification of such ingredient at first is easy to deal with instead realizing and encountering such conditions afterward within the transaction stage. The central financial institution in any country provides complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such situations.

What do they mean for CDD. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied.

Aml In Switzerland Reform Of Money Laundering Act Amla In 2021

Individuals and companies can be prosecuted even if the money laundering took place entirely outside the UK provided that a significant portion of the predicate criminal conduct took place in the UK and had harmful consequences in the UK.

Who is subject to the money laundering regulations 2017. The 2017 Regulations require firms in the regulated sector to implement AML compliance programs with the following components. Money Laundering Regulations 2017. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk.

This has been a legal requirement since 26 June 2017. Firms will need to embed these changes into their documentation and practices. Under Article 83 and Article 84 of the Fourth Money Laundering Directive the regulated sector are required to establish and maintain policies controls and procedures to mitigate and manage.

Reforms of the suspicious activity reports regime and the supervisory regime are underway and our commitment to public-private partnership is embodied in the development of the Joint Money Laundering Intelligence Taskforce which continues. 2 The records are a a copy of any documents and. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities.

A a relevant person who is subject to these Regulations under regulation 8. It is for all entities providing audit accountancy tax advisory insolvency or related services such as trust and company services by way of business. However you should be aware that the presence of one or.

Customer Due Diligence CDD Under the Money Laundering Regulations 2007 if a customer or product fell into one of the listed categories. 1 Subject to paragraph a relevant person must keep the records specified in paragraph for at least the period specified in paragraph. Suddenly there is a sense of urgency around the UKs implementation of the fourth Money Laundering.

This guidance has been updated for the 2017 Regulations and approved by HM Treasury. The Money Laundering Regulations 2017 bring the latest international regulatory standards into UK law. Aa identification or mitigation of the risks of money laundering and terrorist financing to which the relevant persons business is subject or bb prevention or detection of money laundering.

B a person who carries on business in an EEA state other than the United Kingdom who is i subject to the. B a person who carries on business in an EEA state other than the United Kingdom who is i subject to the. A another relevant person who is subject to these Regulations under regulation 8.

Firms must take steps to identify and assess money laundering risks which usually includes keeping a written. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the. POCAs suspicious activity reporting requirements apply only to firms in the regulated sector and in.

Firms that are within scope of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the money laundering regulations must have a written firm-wide risk assessment in place. There are more particulars within MLR 2017 as to who must be subject to the policies procedures and controls. Overview Whole firm risk assessment s18.

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Anti Money Laundering And Counter Terrorism Financing

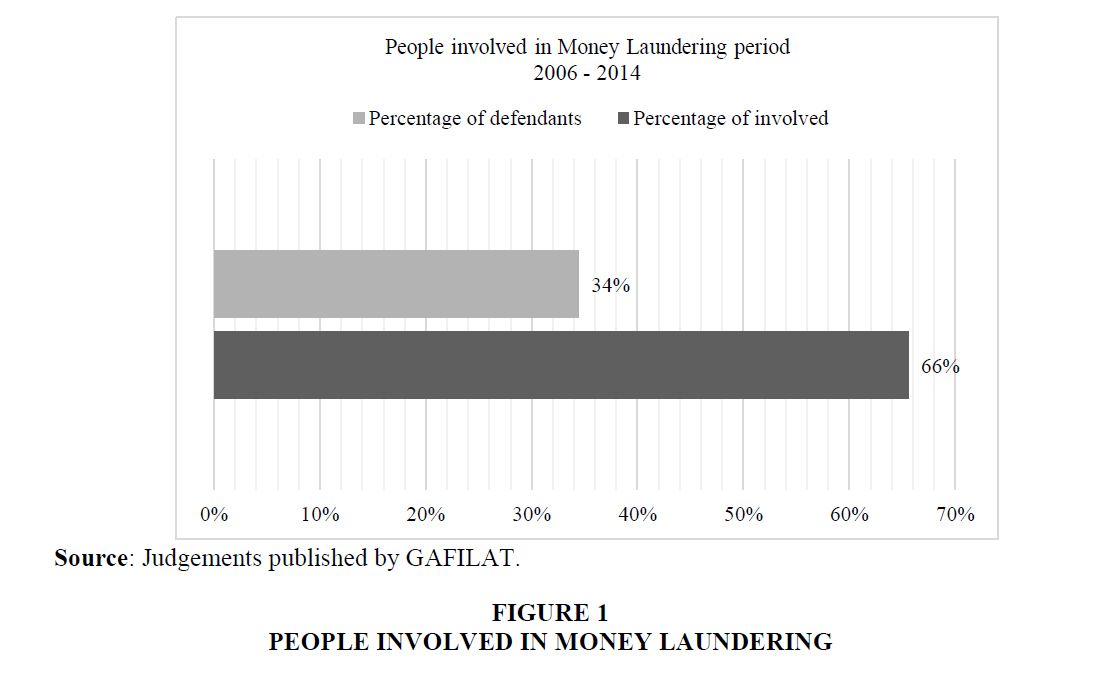

Money Laundering In Ecuador Profile Of The Involved Person And The Socio Economic Impact

Money Laundering Methods In The Megaserver Case Download Scientific Diagram

Anti Money Laundering Policy Pdf

Anti Money Laundering And Counter Terrorism Financing

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Pdf Anti Money Laundering Regulations And Its Effectiveness

Papua New Guinea Anti Money Laundering And Combating The Financing Of Terrorism Mutual Evaluation Report

Anti Money Laundering And Counter Terrorism Financing

Cryptocurrency Money Laundering Explained Bitquery

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Art Market In The Frame Of Money Laundering

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Prevention Of Money Laundering Gov Si

The world of rules can appear to be a bowl of alphabet soup at occasions. US money laundering regulations are not any exception. Now we have compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting agency targeted on protecting financial providers by lowering threat, fraud and losses. We've got big bank expertise in operational and regulatory risk. We have now a robust background in program management, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many adverse penalties to the organization due to the dangers it presents. It increases the likelihood of major risks and the chance price of the bank and in the end causes the bank to face losses.

Comments

Post a Comment